Environmental, Social, and Governance (ESG) issues are no longer just the concern of sustainability teams. They are boardroom issues—tied directly to strategy, risk, compliance, and stakeholder trust. Yet many boards are still playing catch-up.

With the introduction of the Corporate Sustainability Reporting Directive (CSRD) and increasing investor scrutiny, ESG literacy is fast becoming a requirement for effective corporate governance. The question is no longer if boards need to engage in ESG—but how ready they are to do so.

Why ESG Literacy at the Board Level Matters

1. Regulatory Responsibility Has Shifted Upward

The CSRD requires sustainability disclosures to be included in the management report, not as a separate sustainability statement. That means the board is directly accountable for the content, accuracy, and relevance of ESG disclosures. This represents a structural shift: ESG is now part of statutory reporting—subject to audit, assurance, and liability.

2. Risk Exposure Is Expanding

Boards are used to overseeing financial and operational risk. But ESG introduces new exposures:

- Climate-related financial risks

- Human rights due diligence gaps in supply chains

- Reputational risks from sustainability misstatements

- Governance failures related to diversity, ethics, and transparency

These risks aren’t theoretical—they’re already impacting brand value, investor confidence, and regulatory sanctions.

3. Stakeholders Expect a Strategic ESG Narrative

ESG is increasingly tied to access to capital, procurement contracts, and talent retention. Boards must be able to articulate:

- How ESG supports long-term business strategy

- What material sustainability risks the company faces

- How ESG performance is measured and improved

In short, ESG is becoming a language that boards must speak fluently.

Signs Your Board May Not Be ESG-Ready

- ESG is treated as a standalone topic once per year, not integrated into risk and strategy discussions

- No clear ownership or reporting line to the board for sustainability matters

- ESG dashboards are disconnected from risk, compliance, or performance KPIs

- Board materials focus on reputational framing, not risk exposure or control effectiveness

- The board lacks training or access to ESG-related risk insights

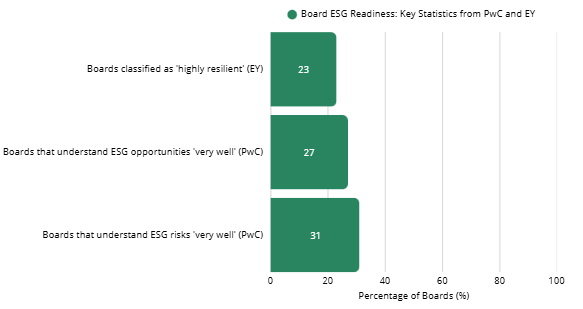

In fact, a PwC board survey found that only 31% of directors say they understand ESG risks “very well”, and just 27% report strong understanding of ESG opportunities (source). Meanwhile, EY’s Global Board Risk Survey classifies only 23% of boards as “highly resilient”—with most underprepared for the increasing complexity of ESG, climate, and regulatory threats (source).

These figures highlight a mismatch between board-level attention and actual readiness to govern ESG-related risks and obligations.

Making Your Board ESG-Literate: A Practical Path Forward

1. Integrate ESG Into Enterprise Risk Reporting

Use your risk and compliance systems to present ESG risks in familiar formats—heatmaps, control matrices, and trend analysis. This helps demystify ESG and makes it actionable.

2. Develop ESG KPIs That Link to Strategy and Risk Appetite

Boards don’t need hundreds of sustainability metrics. They need a few key indicators that connect ESG performance to business outcomes, compliance thresholds, and stakeholder expectations.

3. Enable Evidence-Based Oversight

Board members should have access to assurance-ready data: risk ownership, control effectiveness, incident tracking, and audit outcomes. This builds trust in both the process and the reporting.

4. Support with Training and Tools

A board-level ESG induction doesn’t need to be overwhelming. Short, focused sessions on material risks, stakeholder expectations, and the regulatory landscape go a long way.

How Our Platform Helps Bridge the ESG Knowledge Gap

Riskely is designed to connect governance, risk, compliance, and ESG into a single operational framework—so the board sees what matters, where the risks are, and how well they are managed.

We support ESG governance by:

- Linking sustainability risks and controls to your enterprise risk register

- Creating board-ready dashboards and reports that combine ESG and traditional risk data

- Tracking ownership, control effectiveness, and compliance with CSRD/ESRS

- Offering a digital audit trail to support board-level oversight and external assurance

With the right platform, ESG becomes more than a reporting obligation—it becomes a structured, risk-based practice that your board can understand, question, and govern.

Final Thought

ESG literacy is fast becoming a baseline expectation for boards—not a differentiator. The good news is, the path to getting there doesn’t require reinventing governance processes. It requires better integration, clearer data, and the right tools to make ESG part of how decisions are made.

Want to strengthen board oversight of ESG?

Let’s talk about how our platform can help you operationalize ESG within your governance and risk management structure.